A Breakthrough in Blockchain Staking: Solana Outpaces Ethereum

The Blockchain Technology landscape is continually evolving, and a significant shift has been observed in how users are participating in Staking across various networks. Staking, a process that involves locking up cryptocurrencies to support network operations and Security in Exchange for Rewards, has seen a pivotal change. Specifically, Solana has recently outstripped Ethereum in terms of staking ratio, marking a notable milestone in the Blockchain sphere.

The Rising Staking Numbers: A Closer Look

In a shocking Development for the Crypto community, Solana's staking ratio has soared to 68%, vastly exceeding Ethereum's 28%. This discrepancy sheds light on the changing dynamics and user engagement within these leading blockchain Platforms.

Staking is not just about securing the network; it's a barometer of trust and participation within the ecosystem. The information garnered reveals the evolving preferences and growing faith in Solana's system. Staking can be broadly categorized into native and liquid staking. Native staking involves the direct locking of tokens within the network, while liquid staking offers users the flexibility to stake their tokens without losing liquidity, leveraging derivative tokens as a means of maintaining access to their assets.

Solana's Staking Wealth Surge

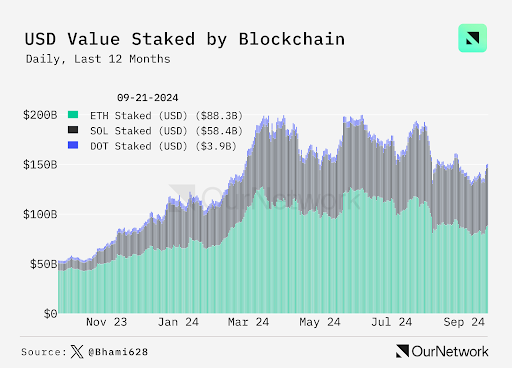

Despite Solana's higher staking ratio, Ethereum retains its crown as the largest Proof-of-Stake (PoS) blockchain by total value locked in staking, boasting over $88 billion compared to Solana's impressive $58 billion. Furthermore, this figure marks a staggering increase from $7.5 billion in September 2023, indicating an injection of fresh capital surpassing $50 billion within a year. This explosive Growth underscores Solana's escalating network engagement and broader Adoption. However, Ethereum's dominance in total staked value underscores its undiminished stronghold as the premier PoS network in terms of asset value.

Polkadot, another player in the field, has also made waves with 58.88% of its supply now staked. Despite trailing behind Solana and Ethereum in absolute numbers—with a substantially lower total value of $3.9 billion staked—Polkadot's substantial staking ratio is noteworthy. It emphasizes the network's growing appeal and the increasing propensity of users to lock in their tokens.

Understanding the Staking Surge

The surge in staking activity, particularly within Solana's ecosystem, indicates a robust and growing confidence among users. Staking serves multiple purposes; it not only secures the network and processes transactions but also offers users a way to earn passive income through their Crypto holdings. The rise in staked value, especially in the case of Solana, suggests an increasing commitment to the network's long-term potential and trust in its stability and Growth prospects.

Disclaimer: The information presented in this article is for informational and educational purposes only. It does not constitute financial advice or advice of any kind. Readers are advised to exercise caution and do their own research before taking any action related to the content.